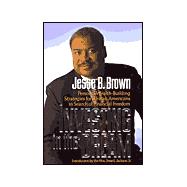

Investing in the Dream : Personal Wealth Building Strategies for African Americans in Search of Financial Freedom

by Brown, Jesse B.; Jackson, JesseRent Book

New Book

We're Sorry

Sold Out

Used Book

We're Sorry

Sold Out

eBook

We're Sorry

Not Available

How Marketplace Works:

- This item is offered by an independent seller and not shipped from our warehouse

- Item details like edition and cover design may differ from our description; see seller's comments before ordering.

- Sellers much confirm and ship within two business days; otherwise, the order will be cancelled and refunded.

- Marketplace purchases cannot be returned to eCampus.com. Contact the seller directly for inquiries; if no response within two days, contact customer service.

- Additional shipping costs apply to Marketplace purchases. Review shipping costs at checkout.

Summary

Excerpts

Chapter One

No Longer Invisible, but Still Underinvested

Jackie Joseph is a hardworking, intelligent and resourceful young woman who is representative of many African Americans in her attitudes about saving and investing. Jackie is a union electrician in Chicago who has proven herself in a field dominated by men--generally white men at that.

I admire Jackie. But I worry about her.

You see, Jackie pays out money to just about everybody but herself.

When her paycheck arrives every two weeks, she hands out money to her elderly father, who is ill. Then she hands more out to her teenage son. And finally, she helps out her best friend, who is going through rough times.

I know all this because Jackie told me. When I asked her if she was ready to sign up for a retirement investment plan that I manage for her union, she explained her situation. I told her she could get started in the plan by putting as little as $10 or $25 into it with every paycheck--a relatively painless way to save for the future. But Jackie just looked at me sadly and said it wasn't possible. Not yet, anyway.

"I just don't have any money right now," she told me.

I know a lot of black folks like Jackie Joseph. In fact, I'd be willing to bet that a high percentage of African Americans who don't have a lot of extra money have reached down deep at one time or another to help out family members, friends, loved ones and coworkers. It is who we are. When you have known hard times yourself, it makes you far more willing to help others. It is part of the best of us.

I am concerned, however, that far too many African Americans plan on starting their own investment savings plans tomorrow . It reminds me of a sign I once saw in a neighborhood bar: Free Beer! TOMORROW! Of course, the free beer never flows because tomorrow never comes. Far too often, people never get around to starting a long-term savings and investment plan. For many, procrastination is the easiest response to the challenge of putting their financial affairs in order. But putting off doesn't pay off.

It's funny how tomorrow never comes but old age sneaks up on you. I know because hardly a day goes by when I don't hear from a client thanking me because I cajoled and prodded him or her to get a nest egg growing. Sometimes people resent that at first, but down the road they bless me. I admire the generosity and caring nature of my fellow African Americans. But I worry about the future of those who have not made their own financial security a priority. As my friend the great motivational speaker Les Brown says, "If you keep on doing what you're doing you're going to keep on getting what you've been getting. So if you don't like what you've been getting, you should change what you've been doing. Prosperity is your birthright!"

By investing wisely, you can turn your savings, however modest, into long-term wealth, just as Jesus turned water into wine. Minister and author Catherine Ponder of the Unity Church Worldwide in Palm Desert, CA, has written that prosperity has a spiritual basis. Just as prosperity is your birthright and your divine right, it is also your responsibility. You are responsible for your own financial health, just as you are responsible for your own physical well-being. Having a dollar and a dream is not enough. You must invest in that dream in order to build lasting wealth.

I was nearly driven to madness when I read recently that the residents in just one predominately black ward of Chicago had spent $70 million on lottery tickets. I guarantee that if you drive through that neighborhood you will not find a single millionaire. What if those people had invested that money wisely instead? What if they had bought Microsoft or Wal-Mart stock? What if they'd bought a mutual fund returning 16 percent a year? Then they could have built long-term wealth that could be built upon and passed from generation to generation. Instead, they bought lottery tickets and threw their hard-earned money out the window.

"History has proven that through hard economic times and boom years, bull markets and bear markets, a disciplined, long-term strategy of saving and investing is the best way to accumulate wealth, and more importantly, pass it on ," notes Earl Graves, publisher of Black Enterprise magazine.

If you don't feel prosperous, it may be that you have not yet committed yourself to prosperity by setting goals and developing and sticking with an investment plan. We deserve security and peace of mind in retirement. But in general, we have poor saving and investing habits--not just blacks, but all Americans. Compared to every other industrialized nation in the world, the United States of America is a nation of savings slackers. We may be the richest nation in the world but we also lead the globe in bankruptcies. According to one poll, one fourth of all adults between ages 35 and 54 have not yet begun to save for retirement. While the US stock market went on an unprecedented bull run in the 1990s, nearly 60 percent of employed Americans missed out because they didn't own stock or an equity mutual fund either on their own or through their employer. "The fact that less than half of the nation's households are participating in this unprecedented creation of stock market wealth is exacerbating the gap between rich and poor that widened in the 1980s and 90s," wrote a Chicago Tribune financial reporter.

BRIDGING THE WEALTH GAP

When anyone starts talking or writing about the rich and the poor, you and I know who stands where. African Americans are among the least aggressive people in the nation when it comes to using our money to create greater wealth through investment. As a result, we get poorer while the rich get richer. "The reality is, no matter how great incomes become for individual blacks, our wealth is not sustained because we have very few assets that can be passed on from generation to generation," noted Hugh Price, president of the National Urban League, in his introduction to a 1998 study of the state of black America's wealth. "Individual self-sufficiency, as important as that is, cannot be the ultimate goal. Black folks must push past that and go for economic power."

Citing the tremendous gap between blacks and whites in the accumulation of wealth, Price said, "It undermines your ability to achieve financial stability, it undermines your ability to carry the tuition load when children reach college age and it affects your ability to carry out your old age in a comfortable style."

The unequal distribution of wealth, power and resources has stagnated growth in black communities, according to the president of the Coalition of Black Investors (COBI), based in Winston-Salem, NC, who believes that in order to build wealth, African Americans must get into the habit of saving and investing, and do so at a higher rate.

In 1952, a great writer named Ralph Ellison eloquently expressed his anger at racism in this country with a novel entitled Invisible Man . This classic story explored the sense of racial alienation experienced by blacks, who were treated as though they were "invisible" by the white majority.

Nearly fifty years later, the thirty-three million African Americans in this country are anything but invisible thanks to many hard-won victories over racial discrimination. Since the Civil Rights era, we have made our presence known in politics, in business and in the marketplace. But we still have one major battle to undertake: The fight for economic independence.

"GOD WANTS US TO PROSPER"

Middle-class African Americans have been blessed with jobs and wealth--we must not bury our gifts or talents. We must multiply them by practicing financial responsibility and investing wisely. As a spiritual people, we must understand that "God wants us to prosper," as my minister the Rev. Dr. Johnnie Colemon is fond of saying. My goal with this book is to inspire and motivate you to join that battle for economic equality, and to help you arm yourself for it. All men and women may be considered equal under the law in this country, but believe me, when it comes right down to it, your net worth is what counts. It determines where you live, where your children are educated and the quality of your life in your retirement years.

Yet, in a household survey conducted by researchers at the University of Michigan in 1998, only 4 percent of African Americans had a net worth of $170,000 or more compared to 25 percent of all others. Half of black families polled in the survey had a net worth below $8,400, while the median for other families was above $63,000.

What do those statistics really mean to African Americans? They mean that while most whites have enough money in the bank to purchase a new car with cash, far too many blacks have difficulty coming up with the full payment for a decent used car. It means that the majority of blacks are far less likely than whites to have the money for a down payment on a first home, or enough money put away for emergencies like a quick flight to visit a loved one in need or even to pay for the funeral of a family member who dies unexpectedly.

Surely there are more prosperous African Americans today than ever before. The growing affluence among black professionals is undeniable. Yet, far too many hardworking African Americans still live paycheck to paycheck and never build lasting wealth--even as whites at the same income levels are putting money into retirement plans, investment clubs and individual retirement accounts (IRAs). There are African Americans capitalizing on the historically high rate of return for the stock and bond markets. There are black men and women whose investments are paying for their children's college educations, for starting new small businesses and for comfortable retirements. But there are not enough of them.

Too many of us are still missing out on the opportunity to turn our water into wine, our tens and twenties into hundreds and thousands, our thousands into tens of thousands and even hundreds of thousands. Some are missing out because like Jackie, they take care of everyone but themselves. Others have missed out because they are afraid to use the money they have as leverage to create the wealth they deserve .

Too often, African Americans regard money as something magical, mysterious or sacred when it is really nothing more than a tool--a very useful and powerful tool that you should learn to use to your greatest advantage. Many blacks I know have stories about an uncle, aunt, parent or cousin who has a life's savings stashed in a shoe box or sock drawer. The only thing that money will grow is mildew. Your savings should not be locked away, buried in the backyard or put in a treasure chest. Nor should your money be wasted on things you don't really need or can't afford to pay for outright. You work hard for your money, and you should make certain that at least some of it is put to work for you and your loved ones.

The secret is to put your money where it will do you the most good; for the last fifty years or so--with a few short-term exceptions--that place has been in the stock and bond markets. The same African Americans who bury their savings in the backyard will have nothing to do with stocks or bonds that have made millions for white investors. Why? Blacks simply have had less access to information about stocks and bonds, and, like all people, they don't trust what they don't know.

I'll let you in on a trade secret: Investing in the stock market really is not very complicated at all. Many times stockbrokers try to make it seem that way so they can impress you, but it really boils down to some pretty simple mathematics and common sense. Many people tell me that they have not taken advantage of stocks, bonds and mutual funds because they feel those forms of investment are beyond their understanding. Believe me, if you can balance a checkbook or put together a household budget, you can learn to understand those investment vehicles and cash in on one of this nation's best methods for building personal wealth.

I am going to teach you many things about investing and building wealth in this book. Some of it may seem complicated at first, but none of it is out of your reach. It is important to understand that if you buy shares of good companies, even just a few shares, your investment will grow substantially over time. That is how wealth is created.

I have written this book because I am concerned that African Americans generally have not worked at building wealth. I hope to inspire, motivate and teach you the basics of wise financial investing and planning so that you and the people you care about can enjoy life without constantly worrying about your finances. I am confident that I can help you because I have already made believers, and investors, of hundreds of black clients across a wide range of incomes.

I am not a miracle worker. I will not promise you instant wealth or surefire investment techniques. But I will teach you the same basic principles that have given hundreds of my clients financial security for the first time in their lives. These working class and professional men and women now have tens of thousands of dollars--in some cases far more. They have a peace of mind they've never known. But I won't have peace of mind until I've spread the word to many, many more!

THE NEXT BATTLE IS FOR ECONOMIC FREEDOM

The African American community is not invisible, but its investment earnings are barely discernible. Blacks in this country are seriously underinvested in the American economy, specifically in that great creator of wealth, the stock market. I understand that in the past you may have been reluctant to invest in stocks, bonds or mutual funds because you didn't think you knew enough about how they worked or what the risks were. Maybe you even had the sense that those investment opportunities simply weren't available to you. I'm here to tell you that they most definitely are open to you and that you should take advantage of them. Don't let lingering racial insecurities or fear of discrimination keep you from' participating in the dynamic American economy. It is your right. You owe it to yourself and to your loved ones. And you deserve it.

Whether you're talking about George Washington Carver, Cotton Mather, the Rev. Martin Luther King, Jr., Louis Armstrong, Oprah Winfrey, the Rev. Jesse Jackson, Sr., or his son, Congressman Jesse Jackson, Jr., African Americans have played a major role in making the United States the dominant social and economic force on the globe. Our sweat, our brains, our hearts, are heavily invested in this country. It is time we invested money in the economy that we helped create, and it is time we cashed in on this nation's success.

We marched courageously and successfully in Selma, Little Rock, Montgomery and Washington, DC. Now we must march on Wall Street. We aggressively claimed our civil rights in this country, but we have been far too passive in pursuing our rightful share of this nation's wealth. We need to be as aggressive about our personal finances as we have been about our individual freedoms.

Survey after survey reports that African Americans in general tend to place their hard-earned money into low-return savings and money market accounts rather than in high-return investments. When most blacks invest, we too often place our money in "safe" things like certificates of deposit or real estate.

Because of our conservative approach to finances, we are not fully sharing in the economic fruits of this great nation. In the middle of one of the longest and biggest buying runs in stock market history, far too many of us have been sitting on the sidelines.

· Only 22 percent of us have invested in mutual funds, compared to 35 percent of white Americans, according to a 1997 study of African American saving and investment habits conducted by Roper Starch Worldwide on behalf of Ariel Capital Management in Chicago.

· Only 27 percent of us have invested in stocks and bonds, compared to 38 percent of the white population, according to the Roper Starch study.

Because we tend to invest more conservatively than whites, we end up with less retirement savings than they have. Nearly twice as many blacks as whites are counting on Social Security to make up at least half of their retirement income, even though more than a third of both blacks and whites believe Social Security will no longer exist by the time they retire.

Analysts who track wealth and income distribution in the United States are concerned that less than half of the nation's households are participating in the stock market. Why? Because those who are invested in it are pulling farther and farther ahead, leaving those who are not farther and farther behind.

FINANCIAL KNOWLEDGE PAYS DIVIDENDS

In general, African Americans don't know enough about investment strategies, and as a result many are afraid to invest in mutual funds and stocks. Blacks of all ages are less likely than whites to describe themselves as "knowledgeable" investors. In fact, 38 percent of African Americans (compared to only 21 percent of whites) say lack of knowledge was a major reason for not investing more of their income.

This is alarming, but I certainly understand why it has happened. I know I certainly didn't hear anything about the stock market when I was growing up. The Dow Jones industrial average (the Dow) was not a topic of discussion at my family's dinner table, nor was our phone ringing off the hook with calls from stockbrokers. The same national brokerage firms that enthusiastically chase white professionals have been notoriously slow to recognize the potential of the African American investor. It could be that those investment firms simply don't know where to look. After all, blacks make up only 2 percent of those selling stocks, bonds, mutual funds and other securities in this country, according to Equal Employment Opportunity Commission (EEOC).

Since there are so few of us working in the industry, most brokerage firms don't have a clue about marketing to the African American community. Not surprisingly, stockbrokers traditionally have done their prospecting for clients in white neighborhoods, white corporations and white country clubs. They have done very little to seek out middle-class investors of any other race. Instead, they have focused on the "status" professions, such as doctors, lawyers and corporate executives.

With far too many black investors ignoring the stock market and investment professionals shunning the African American market, both have missed out. A great many blacks have not benefited as investors, and stockbrokers have failed to take advantage of a huge market. But believe me, it's hurt us more than it's hurt them. The investment brokers have neglected to develop inroads into the most dynamic consumer group in the world, but in the meantime many middle-class African Americans have missed opportunities to greatly enhance their savings during one of the longest and most lucrative bull markets in stock market history.

MY MISSION IS TO TEACH YOU HOW TO INCREASE YOUR WEALTH

I first began to see the disparity between black and white investors while I was working as a researcher and analyst for the Senate Finance Committee, and later for the U.S. Department of the Treasury (the Treasury). Now, as a private investment advisor to hundreds of African Americans of all income levels, it is not only my business but my passion and my mission to assist underinvested minorities in overcoming this one great remaining obstacle to the only true form of freedom in a capitalistic society--financial independence.

For nearly ten years, I quietly went about my mission by working my own turf in Chicago. I met clients in churches, employee cafeterias, construction sites, weddings, funerals and minority-owned businesses. I convinced scores of African Americans to build their savings bigger and faster by investing in the stock market. I don't mind telling you, I made a lot of people a lot richer, or at least a lot more financially secure than they'd ever dreamed.

I went about my mission quietly until the fall of 1997, when a Wall Street Journal reporter spent several weeks interviewing me and accompanying me on my visits to clients in the Chicago area. Why me? Because I was one of the very few financial advisors he'd found who actually sought out minority clients and enjoyed working with them. He spent weeks checking my credentials because he couldn't believe I was for real: a broker who actually cared about the little guy.

"Mr. Brown is a rarity in a field that hasn't done well gathering assets from minorities. About half of his $133 million portfolio belongs to black investors, he says, much of it coaxed from people who had never read a stock table before they met him," reporter James S. Hirsch wrote on the front page of the Wall Street Journal on September 17, 1997.

In truth, I find it disturbing that a national newspaper would consider a professional investment advisor seeking out minority clients to be front-page news. It should disturb every African American that we have been so neglected and so underinvested that it ranks up there with the most significant news of the day. I know it bothered me that blacks were ignored by financial advisors when I first joined a national investment firm's Chicago office as a stockbroker. I had moved from working for the Treasury and the Senate Finance Committee into a major bond firm. After a while, I grew restless because I wanted to be more involved with clients, so I became a stockbroker.

I was in that position only a short time when I noticed that none of my coworkers--all of whom were white--had any black clients. It was apparent that most of them had little or no previous contact with any African Americans because they often treated me as if I were their interpreter to some alien population. They'd ask me questions about famous black athletes or celebrities as if all blacks know each other. Most of them had grown up in all-white neighborhoods and gone to all-white schools, and had never had any dealings with African Americans of any social or economic class. They had no concept of the black community as a diverse and vibrant part of the country's population.

They were stunned to discover that not all of us were poor, Democrat, athletic or musically inclined. Yes, I told them, blacks come in a wide variety of shapes, sizes, abilities, intellects and political inclinations. And believe it or not, the majority of us have regular jobs that allow us to put money away for savings and investment.

In many ways, I was shocked by the ignorance of my white colleagues when it came to the African American community. It is hard to believe that blacks and whites can live so close to each other, but remain so far apart. I did come to be grateful that the white stockbrokers had failed to recognize the great hunger among African Americans for investment advice. They had no idea how much money blacks had to invest.

But I did.

My introduction to saving and investing as a child was probably similar to that of most African Americans. What I learned came from those close to me. When I was twelve years old, my Uncle George gave me a silver dollar and said, "Little buddy, as long as you keep this, you'll never be broke."

Looking back now, I realize that maybe Uncle George was saying that as long as I kept that silver dollar at least I'd have one dollar to my name, but at the time it seemed to me he was telling me to save whatever money came my way. I loved my Uncle George. He was a retired master sergeant who lived to be ninety-two years old. To this day when I go back home to San Antonio, I run into men who remember him as the Worshipful Master of his Masonic lodge and others who fondly remember his work as a church trustee. He first instilled within me the basic concept of saving for the future. It was a simple lesson, but a vital one.

Shortly after Uncle George gave me my first silver dollar, my first dollar of any kind at all, my mother took me to the Alamo Savings and Loan and got me a dime card. Do you remember those? They were cards with slots in them to hold dimes. When you filled one up, you had enough money to purchase a $10 savings bond. I filled a few of those cards up and bought savings bonds as a boy. That was the extent of my exposure to savings and investment until much later in life.

Like most of my peers, I grew up in a very nurturing environment where hard work and saving one's money were emphasized. But there was never any discussion of stocks, bonds, mutual funds or any other way of savings besides the typical bank account. I had to learn that for myself, and so have most other African Americans. Nobody was knocking down our doors to teach us the importance or the value of investing in the stock market.

When I first became a stockbroker in 1988, I tried to play the game the same way my white coworkers played it. I struggled in my first few months as I followed the traditional approach of "cold-calling" white professionals and trying to solicit their business over the telephone. That was what I was trained to do, but it didn't work very well for me. Even when I did manage to sign clients, I found that I was spending so much time trying to sell them stocks, bonds and mutual funds--because that was how I earned my commissions--that I really wasn't doing what I wanted to do, which was to manage clients' portfolios to fit their specific needs, interests and goals.

One day, after several months of struggling and feeling discouraged, I asked the advice of a successful senior stockbroker at the firm. He seemed to have a lot of clients, and he appeared to be making a lot of money simply by talking to them on the telephone all day.

I told him that I'd been working harder than I ever had in my life, coming into the office at 7:00 A.M. and calling hundreds of potential clients but having limited success. "All the while, I've been watching you too," I told him. "You seem so relaxed. You come in later in the morning, sip coffee and chat on the phone to clients who seem to throw money at you all day long. How do you do it?"

He told me that the secret to being a successful broker is to identify a niche market and develop long-term trusting relationships with it. Interestingly, his niche market was built around his love for seventeenth-century classical music by composers like Johann Sebastian Bach. He was president of the Baroque Society in Chicago, and most of his clients were music lovers whom he met through their shared interest.

I will resist all temptation to make a pun about his amazing ability to sell stocks and bonds to a bunch of "baroque" clients, but it did dawn on me that if he could build a lucrative client base based on his relationships with fellow music lovers, I could do the same thing by developing business relationships among people with whom I shared experiences and interests.

I only had to look at all the white faces in my office to determine where my unique niche should be. There I was, a black stockbroker in Chicago, home of some of the most successful and affluent African Americans in the world, not to mention a thriving black middle class. Once I identified my niche market, I only had to go out and talk to people. I didn't even have to wander off my normal path. I found them in my neighborhood, at my church, at gatherings for my college fraternity, in my grocery store and at social functions. It's amazing how easy invisible people are to find!

In this book, I'll be telling you about many of my clients and their success stories. At this point I want to introduce you to one of my favorites. His name is Charlie Jones. I love this guy, and his story is typical of the people with whom I deal.

Charlie is a maintenance supervisor and union steward at the huge McCormick Place convention hall on the shore of Lake Michigan in Chicago. For many years my company had a contract to manage the retirement plan for Charlie and the other employees of the Metropolitan Pier and Exhibition Authority, which operates McCormick Place. I helped invest their savings in mutual funds so that they would have enough money to be comfortable in their retirement years. There are 526 Metro Pier employees and I helped more than 450 of them enroll in one mutual fund plan or another. Now, I did earn commissions from those enrollments. But believe me, if I were in this purely to make money for myself, I probably would be hanging out with all those white stockbrokers, hustling for clients at their country clubs. I get much more satisfaction in helping people like Charlie.

I met Charlie one day while visiting with clients at McCormick Place. I would check in on them frequently to make sure things were going all right and to see if anyone had questions. Charlie was sweeping the floor when I walked in and we struck up a conversation. I asked him if he was enrolled in the deferred compensation retirement plan that I manage for his employer. "No, I live paycheck to paycheck like most people I know," he said.

Later in the book, I will describe these plans in detail to you, but for now, you should understand that they are perhaps the greatest thing that has ever happened for working men and women in this country. By having a small portion of each paycheck automatically taken out and put into stocks, bonds and mutual funds each pay period, millions and millions of Americans have been able to save more for their retirement than they had ever dreamed possible.

Like far too many people, though, Charlie had not enrolled in his company's retirement plan because he felt he didn't know enough about how it worked. Looking back, he remembers having a sense of helplessness when it came to investing. "In the black community, most people know next to nothing about investing their money," Charlie said. "I didn't understand stocks. I didn't know that you didn't have to be a millionaire to invest in stocks or bonds or commodities. I was frustrated because when Jesse started talking about it to me, it wasn't something I could relate to at all. Like most people, I thought putting twenty dollars a week in the bank was saving, but he showed me how to put it into the stock market so it would grow into something."

In talking to Charlie that first day, I learned that he was divorced and that he had custody of a young son. I asked Charlie if he was setting aside any money for his son's future, or in case something happened to him before the boy reached adulthood. Charlie said that he hadn't been able to save much. He also said that he dreamed of his son going to college one day so that he could have a better job and maybe an easier life than he'd had.

It bothers me to think that men and women who work that hard easily might end up one day with no place to live, or no one to care for them in their later years. I know it doesn't have to be that way. Even people who don't make $40,000 or $50,000 a year can save a little at a time and then take advantage of investment opportunities that can provide them with security for the rest of their lives.

Charlie makes $35,000 a year, which would put him solidly in the middle class of this country--a group that does not include nearly enough people who look like me and Charlie. Out of the 33 million African Americans in this country, about 12.5 million of them have middle-class incomes. With his income, Charlie should be doing better. I'm not saying that he will ever be able to retire to a condominium in Florida, but there is no reason that he should ever have to go hungry or go without a place to live even after he retires, if he saves and invests wisely.

After talking with him on several occasions, I got Charlie to enroll in the retirement plan. He started investing just $20 a week and within a relatively short time, he had $5,000 saved up. Sadly, it turned out that Charlie needed that money long before he was ready to retire because his mother died unexpectedly. She had no money, and no one else in the family could pay for a funeral. Charlie had to go into his retirement savings and take out $2,000 to bury his mother properly. I don't advocate taking money out of retirement savings because there is generally a big tax penalty, but sometimes you don't have any choice. Charlie was grateful that I had talked him into joining the retirement plan, because otherwise he wouldn't have had the needed money and his mother would not have had a proper burial.

"When I told Jesse about the situation with my mother's funeral, he helped me take care of it, and it was like having a great burden lifted off my shoulders when I realized that I could use my savings from the retirement account. Instead of being dejected, I was proud that I was able to take care of her funeral," Charlie said.

A well-conceived investment plan is a form of life assurance ; if you stick with it, the wealth you build will provide you with the assurance that you will have what you need, when you need it the most. It takes a little money to get started with this plan, but it takes even more of an investment in the truth. You have to accept the truth that saving money is vital to your future happiness and security.

Now, let me show you how to do it.

Copyright © 2000 Jesse B. Brown. All rights reserved.

An electronic version of this book is available through VitalSource.

This book is viewable on PC, Mac, iPhone, iPad, iPod Touch, and most smartphones.

By purchasing, you will be able to view this book online, as well as download it, for the chosen number of days.

Digital License

You are licensing a digital product for a set duration. Durations are set forth in the product description, with "Lifetime" typically meaning five (5) years of online access and permanent download to a supported device. All licenses are non-transferable.

More details can be found here.

A downloadable version of this book is available through the eCampus Reader or compatible Adobe readers.

Applications are available on iOS, Android, PC, Mac, and Windows Mobile platforms.

Please view the compatibility matrix prior to purchase.